Paying back your equity loan

When you take out your equity loan, you agree to pay it back in full - including interest and management fees.

You can either pay in full:

1) at the end of the equity loan term (25 years)

2) when you pay off you repayment mortgage

3) when you sell your home

Remember there are no monthly equity loan repayments to reduce to amount of equity loan you borrow, and you can pay off all or part of your equity loan any time before then

If you do not comply with the terms set out in the equity loan contract then you can be asked to repay the loan in full.

How paying back the loan interest works

For the first 5 years, your equity loan is interest-free

You pay a monthly managements fee of £1 via direct debit

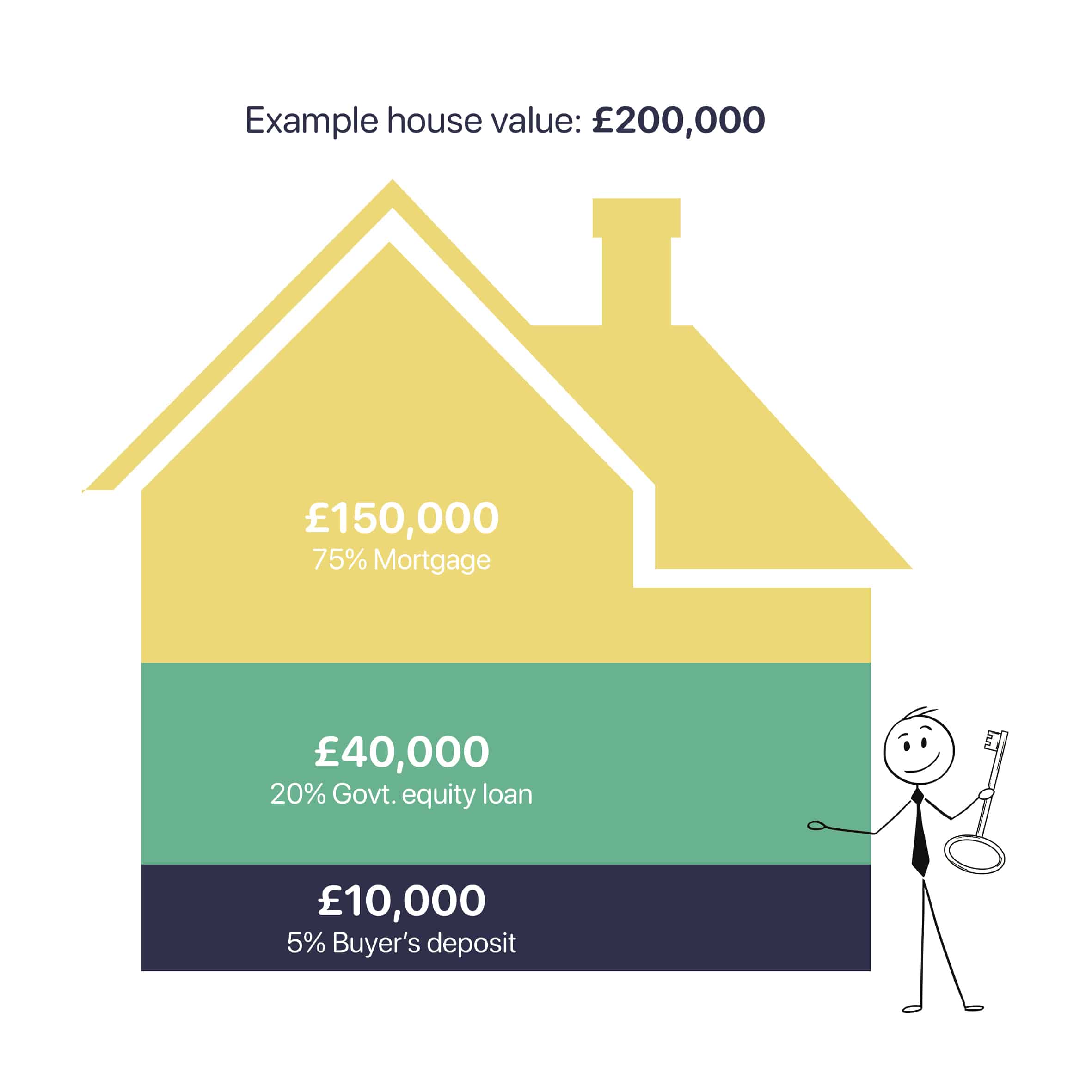

So with our example property worth £200,000 your total monthly payments would be £1, and your annual payments would be £12.

You pay interest of 1.75%

You still pay your monthly management fee of £1 via direct debit

So with our example property worth £200,000, your total monthly payments would be 1.75% of £40, 000 which is £58.33 or £700 annually.

This means your monthly repayments would be £58.33 plus you £1 monthly management fee so a totally of £59.33.

Annually you would be paying £700 plus you £12 monthly management fee so £712 for the year.

Each April the interests rate go up by the Consumer Price Index (CPI), plus 2%

You will still pay your monthly management fee of £1 via Direct Debit

So with our example property worth £200,000, your total monthly payments would be 1.75% plus (1.75 x CPI + 2%) currently that would be 1.75% + 0.08% so a new interest rate of 1.83%.

This means your monthly repayments would be £61.00 plus your £1 monthly management fee so a total of £62.00

Annually you would be paying £732 plus your £12 monthly management fee so £744 for the year.

Some tips!

Remember you may pay back more than you borrow.

Your equity loan amount is determined by the market value of your new home when you buy it.

This means when you pay back your loan, whether it is in full or in part, will be determined by the percentage of the market value at the time you chose to repay.

If the value of your home rises, so does the amount you owe on the equity loan, and if the value of your home falls, so does the amounts you owe on your equity loan.

It is important to consider how you will manage your mortgage repayments if your home drops in value. If your home is worth less than when you bought it, it may affect your repayment mortgage so make sure you talk to a financial adviser about what you could do if this happens.